9. Which Of The Following Calculations Ignores The Impact Of The Time Value Of Money?

Time Value of Coin Definition

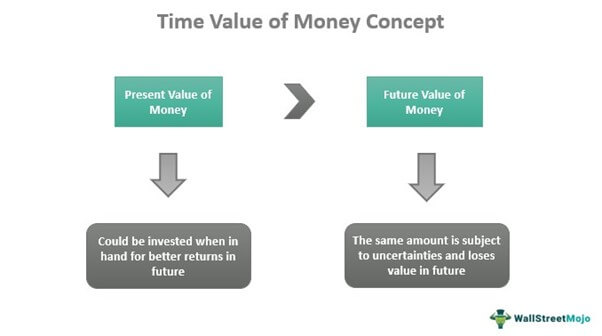

Time Value of Money (TVM) is a fundamental financial concept, stating that the current value of money is higher than its future value, given its potential to earn in the years to come. Thus, information technology suggests that a sum of coin in mitt is greater in value than the same sum of money received in the next couple of years.

You lot are free to use this image on your website, templates etc, Delight provide us with an attribution link Article Link to be Hyperlinked

For eg:

Source: Time Value of Money (wallstreetmojo.com)

Also referred to every bit the present discounted value, TVM is determined by its ability to yield returns in terms of its future value The Futurity Value (FV) formula is a financial terminology used to calculate greenbacks flow value at a futuristic date compared to the original receipt. The objective of the FV equation is to determine the future value of a prospective investment and whether the returns yield sufficient returns to cistron in the time value of money. read more . A person having the coin in paw can invest it for better returns in the future. On the other hand, the same amount received a twelvemonth after, information technology loses its value.

Tabular array of contents

- Time Value of Money Definition

- Time Value of Coin Explained

- Formula

- Example

- Time Value of Money Analysis

- Frequently Asked Questions (FAQs)

- Time Value of Money Video

- Recommended Manufactures

- Time Value of Coin (TVM) is the basic financial concept that advocates how the current value of coin is higher than its value in the time to come.

- It is the potential earning capacity of the money that decides its current and future value.

- TVM helps investors make the best investment decisions, knowing the future returns they should expect from what they invest.

- Coin loses its value over time, which causes inflation affecting the ownership power of the public.

Time Value of Money Explained

Time Value of Money comprises one of the most significant concepts in finance. The idea focuses on identifying the real value of cash flows Cash Period is the corporeality of cash or cash equivalent generated & consumed past a Company over a given catamenia. Information technology proves to be a prerequisite for analyzing the business's strength, profitability, & scope for betterment. read more expected in the future due to the business or individual investment decisions fabricated from time to time.

For example, A wins a lottery of $ane,000 and has two options to either take a lump sum right at the moment or receive the same after a yr or ii. It is obvious for the winner to cull the first selection equally the winner tin invest that money and receive $1,200 or more in the next two years. Simply, on the other hand, if A chooses to go otherwise, it will be the same $1,000 even afterwards ii years.

TVM is an important factor in determining the purchasing power, and hence it is considered an important concept in inflation The rise in prices of goods and services is referred to as inflation. One of the measures of inflation is the consumer price index (CPI). Charge per unit of inflation = (CPIx+i–CPIx )/CPIx. Where CPIx is the consumer price index of the initial year, CPIx+ane is the consumer toll index of the post-obit year. read more . TVM is hugely affected during aggrandizement as the latter hampers the purchasing power of money, leading to the loss of its value.

Formula

TheFourth dimension Value of Money formula is expressed below:

Or,

Here,

- PV = Nowadays value of money

- FV = Future value of money

- i = Charge per unit of interest or current yield on similar investment

- t = No. of years

- due north = No. of compounding periods of interest each yr

Example

Permit u.s. understand the TVM calculation through the post-obitTime Value of Coin case:

Mario purchases a stock expected to pay dividends Dividends refer to the portion of business earnings paid to the shareholders as gratitude for investing in the visitor's disinterestedness. read more of $twenty (Div 1) adjacent twelvemonth and $21.6 (Div 2) the following year. As he receives the second dividend, he plans to sell the stock for $333.3. What is the intrinsic value Intrinsic value is defined as the net present value of all future free cash flows to equity (FCFE) generated by a company over the form of its existence. It reflects the true value of the visitor that underlies the stock, i.e. the amount of coin that might be received if the company and all of its avails were sold today. read more of this stock if the required return is fifteen%?

To make sure the required return is xv%, Mario attempts to find out the stock's intrinsic value.

First, the investor calculates the present value Present value factor is factor which is used to indicate the present value of greenbacks to be received in time to come and is based on time value of money. This PV factor is a number which is always less than one and is calculated by one divided by one plus the rate of interest to the power, i.east. number of periods over which payments are to be made. read more of Dividends for Year 1 and Year 2.

Using the in a higher place formula, he gets,

- Present Value (Year 1) = $20/ ((1.15) ^ i)

- Nowadays Value (Year 2) = $twenty / ((1.xv) ^two)

- In this example, they come out to be $17.iv and $16.three, respectively, for 1st and 2nd-yr dividends.

Secondly, he computes the present value of time to come selling toll after ii years.

PV (Selling Cost) = $333.3 / (1.xv^2)

= 252.0

Now, Mario adds the nowadays value of dividends and the present value of selling price to get the intrinsic value of the stocks

Present Value (Year one) + Present Value (Twelvemonth 2) + Present Value (Selling Price)

= $17.4 + $xvi.3 + $252.0

= $285.eight

Fourth dimension Value of Money Analysis

TheTime Value of Coin conceptdetermines the potential earning chapters of an amount in the future. Information technology, therefore, helps different financial sectors The financial sector refers to businesses, firms, banks, and institutions providing fiscal services and supporting the economic system. It encompasses several industries, including banking and investment, consumer finance, mortgage, coin markets, real manor, insurance, retail, etc. read more than to sympathize and compute the nowadays value and compare the same with the future value of a particular amount. Based on the results obtained, they decide whether to invest in a particular venture, asset, or security.

You are complimentary to use this prototype on your website, templates etc, Please provide us with an attribution link Article Link to be Hyperlinked

For eg:

Source: Time Value of Money (wallstreetmojo.com)

The financial firms use this idea of TVM for the post-obit purposes:

- It helps in comparing the investment alternatives available in the market. Investors appraise the returns and other atmospheric condition to make a final conclusion on what pick to choose.

- Investors choose the best investment proposals based on the evaluation, considering the TVM.

- Lenders determine the interest rates for loans, mortgages A mortgage is a type of loan that allows y'all to borrow money from a banking company or other fiscal institution, typically for real estate investment. Furthermore, the Mortgage Formula considers the outstanding loan corporeality every bit well every bit the stock-still monthly payment. read more , etc., based on the present and hereafter value of an amount.

- The value of money, when known, helps in fixing advisable wages and prices of products.

In addition, the irresolute value of an corporeality as well plays a considerable office in determining when a particular investment matures or when to repay a loan amount, etc.

Frequently Asked Questions (FAQs)

What is the Time Value of Money?

TVM is the cardinal fiscal concept that revolves around the irresolute value of money over time. It states how the nowadays value of money is greater than its future value. The value that money holds currently and in the future is assessed based on its potential earning capacity.

Why is TVM important?

The 3 main reasons that make TVM an important concept are – inflation, run a risk or doubtfulness, and liquidity.

• Inflation is the loss of purchasing ability caused by the deteriorating hereafter value of money.

• Risk or incertitude is the deviation between what is received as an issue and expected when the investment or expenditure was made.

• Liquidity makes it easy for owners to sell their assets for cash as illiquid assets are difficult to sell.

How does TVM impact fiscal decision-making?

Calculating TVM is of import every bit information technology helps financial sectors make suitable investment decisions. Using the concept, the key investors compare the bachelor investment options and choose the best alternatives to invest in. Then, given the expected loss in the value of money, the rate of interest and tenure of repayment for loan and mortgage schemes are determined. In improver, determining TVM also helps ready the wages of workers and prices of consumer goods.

Fourth dimension Value of Coin Video

Recommended Manufactures

This has been a Guide to Fourth dimension Value of Coin definition & its significance. Here nosotros discuss examples to show how to use the TVM formula to summate money value. You may learn more about financing from the post-obit articles –

- Key Differences – Time vs Coin The principal distinction between Time and Money is that Time is the number of hours spent doing work. Money, on the other hand, is the amount earned for performing the work. read more

- TimeValue in VBA VBA's Time Value function is part of the date and time category, and it returns the numerical value of the date provided in as an statement. read more

- Present Value Example Present Value (PV) is the today's value of coin you lot expect to become from future income. It is computed as the sum of future investment returns discounted at a certain rate of return expectation. read more than

- Examples of Bail Yield Formula The bond yield formula evaluates the returns from investment in a given bond. It is calculated equally the percent of the annual coupon payment to the bond toll. The annual coupon payment is depicted past multiplying the bond's face value with the coupon rate. read more than

Source: https://www.wallstreetmojo.com/time-value-money/

Posted by: patelsamses.blogspot.com

0 Response to "9. Which Of The Following Calculations Ignores The Impact Of The Time Value Of Money?"

Post a Comment